Can You Get Late Payments Removed From Credit Report Due To Covid

Camila Farah

Be advised that the negative accounts on my credit report are related to the coronavirus.

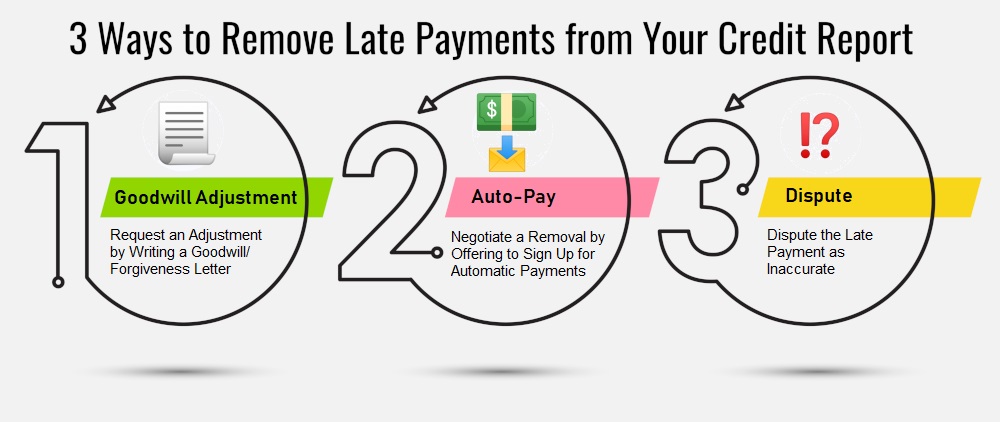

If they agree to let you skip a payment make sure you get it in writing. If the report is accurate it can be difficult and time consuming to get the payment removed from your reports and it likely won t be removed for seven years. They will work with you to determine how best to move forward and get you back on track. A goodwill adjustment is when a creditor agrees to remove a late payment from your credit report as a show of goodwill note.

Consider adding a consumer statement to your credit reports you can add a brief 100 word 200 words in maine to your credit reports to explain your situation. Due to covid 19 most all major. If you ve entered into payment forbearance or deferment agreements with your lenders payments that are reduced or suspended during forbearance will not be considered delinquent and will not affect your account s standing on your credit reports. An example of a consumer statement.

2 if the late payment is incorrect it can be relatively easy to fix the error. Even better is that there are several ways to get the late payment permanently deleted. You can reach out to your lender or creditor and find out what options or programs are. Goodwill adjustments can be tricky.

RELATED ARTICLE :

- can you get a zit on your lip

- can you get a zit on your tongue

- can you freeze brussel sprouts without blanching them first

You never paid late and the lender or credit bureau made a mistake adding the payment to your report. The way credit scoring works delinquencies have less impact over time and paying on bills on time once your income stabilizes. However contrary to popular belief you do not have to wait up to seven years before being able to get a mortgage car loan or any other type of credit again. Creditors may reward a request supported by one or more mitigating factors that contributed to the late payment but are under no obligation to do so.

Under the cares act in certain situations lenders are required to report your accounts as current. If you make partial payments or miss them altogether without formalizing an arrangement with your lender even if your missed payments are covid 19 related you can expect them to be reported to the credit bureaus and to appear on your credit. And if you re going to work with a creditor to make different payment arrangements you probably want to watch your report regularly.

Source : pinterest.com